Value Investing

Our goal is to identify companies at times of undervaluation due to market forces or investor perceptions by employing a disciplined research process designed to identify companies with extraordinarily strong balance sheets, recurrent free cash flow and strong competitive positions. Our aim is to benefit from temporary discrepancies in the stock price of a company versus its value.

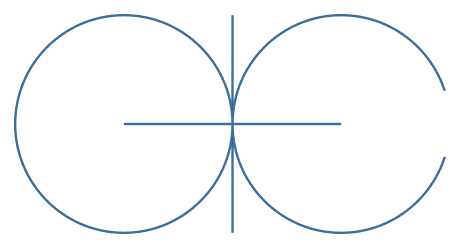

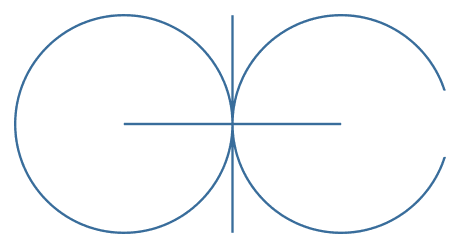

Critical to our value investment discipline is an aversion to permanent capital loss. Math demonstrates that to recover from a 50% decline requires a return of 100%. Our effort to mitigate capital loss is embedded in our investment process and is rooted in our commitment to companies with little to no leverage.

The most important message for our clients is that our personal investments and interests are aligned with theirs. We maintain the belief that a few well-researched ideas, held for a significant period of time will provide superior risk adjusted results. Our portfolios incur very low turnover and benefit from favorable tax treatment afforded to long term capital gains and low transaction costs.

Proprietary Research

Founded in 1984 with a strict value approach, our research includes a focused in-depth knowledge of each company and a fundamental understanding of their products and/or services. Beyond the financial statements, we meet with management teams, conduct site visits, and speak with others in the industry including competitors, customers, and others in the supply chain.

Oppenheimer + Close, LLC is a federally registered investment advisory firm based in New York City. We manage equity investments for individuals, pension funds, family charitable trusts and foundations through individually managed accounts as well as three domestic partnerships.